I love a merger. You inevitably hear about all the horrible no-good unprofitable customers you were forced to set free. It’s like the high school reunion, where you discover the math nerd is a bitcoin billionaire and the head cheerleader is living in a trailer park.

The last time we spoke about these “unprofitable customers”, we heard some harsh words. They were evil personified, sucked cash like Dracula, and the key reason our annual meeting lacked an open bar.

So we cast them into the outer darkness.

So, Who Are Your Accounts?

So imagine our surprise when we sit down to our first “joint” business review with our new “partners” after the big day and find out one of their best accounts is….. THEM.

Yes, those guys, the ones who insisted we get dirty dog low on fancy wrapped soap bars and refused to buy anything else from us. The ones who put us out to bid every ninety days. Evil personified, according to our finance team.

“Great Account! Wish we had another dozen like them!

What Accounting Can’t See May Hurt You

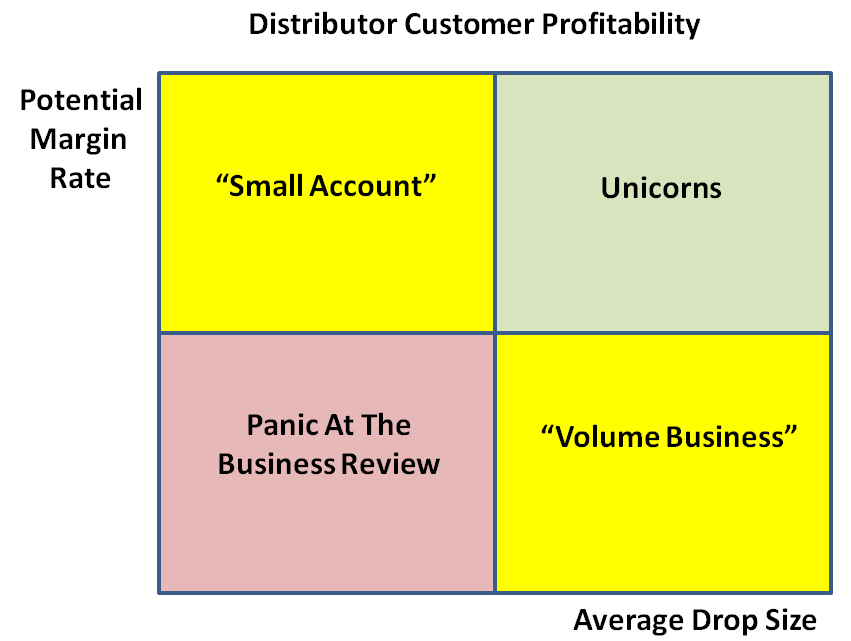

Customer profitability for distributors is driven by order size and margin rate, especially if everyone on the team is selling the same service and receiving the same commission plan. While this isn’t a perfect model, we can easily use it to lay out a simple 2 x 2 assessment of our customer base. Which we do below.

Not bad for a first pass. Most distributor sales managers can put a customer name or two into each of these boxes.

For most management teams, the next step is intuitive. Just draw up a list of unprofitable customers and hit them with either a price increase or a new minimum order! Boom. The business is instantly more profitable.

But are we looking at the business the correct way?

What Would Our Customers Say?

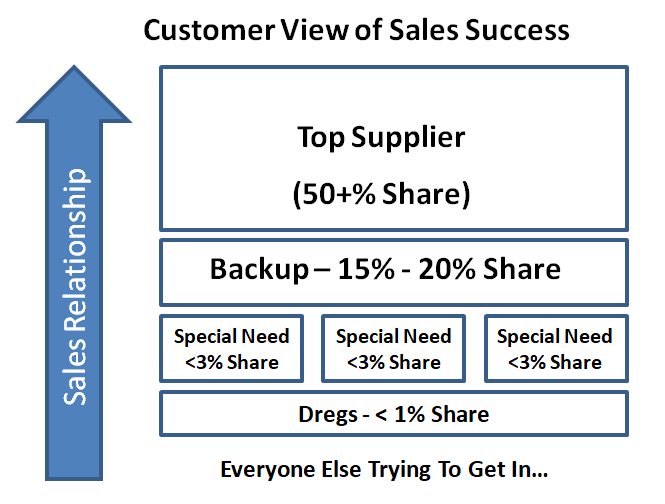

If we think about our relationship from the perspective of a potential buyer, we see a very different world. The customer probably buys a variety of similar items, only some of which we can sell them. Perhaps they also want a backup vendor.

Most buyers organize their spend into categories of similar products and rank the vendors within that universe. There are often significant advantages to consolidating spend with a few top suppliers – better prices, better service, less effort. This needs to be balanced against having reliable supply (what if a top supplier stops shipping) and access to a full range of products (such as specialty items).

The view below is typical of how many buyers split up their spend. A top supplier and a heir apparent. Some specialists rounding out the list with unique items. And a lot of people trying to get into the game.

Some lucky vendor has the lead position, making them the go-to source for that particular product category. They clearly “won” the relationship building contest.

Second place is also taken seriously – and will inherit the account if the lead vendor stumbles over a service issue. They earn honorable mention.

The Buyer’s View of Your Profitability

Believe it or not, most sane buyers want their top vendors in a product category to be reasonably profitable. There’s too much riding on those vendors to deal with a constant stream of efforts by the vendor to “get back to even”. This doesn’t mean they’re going be gentle about things, but only a fool puts the core of their business on an unsustainable supplier.

Below that level, it’s open season. You can aggressively squeeze your middle tier vendors without risking supply. There’s inevitably someone else who will take their place. Sometimes the squeeze is on price, other times it comes in the form of tolerating small orders and low volume items.

The dividing line is how the customer compares your value to the rest of their vendor base. Convince them that you can bring some unique value to the table and you will be taken seriously as a potential partner. Allow the customer to believe that your company is one of many and you will be treated like a commodity – used and abused for their profit.

Who is responsible for creating this distinction? Sales.

Unprofitable Customers => Incomplete Sales?

What if we stop thinking about the goal of a sales call as getting an order? Because a really good sales effort will accomplish more than that – it gives you a relationship, potentially one which can grow beyond the initial pitch.

An informed advocate within the ranks of your customer’s management team can do a lot to advance your cause. They are plugged into the inner workings of the accounts and can bring you opportunities that have never been put out to bid. Along the same lines, they are a potential ally in the event you need help in addressing a pricing or service problem.

An incomplete sale occurs when we get the order but fail to establish a real advocate within the account. We may enjoy the business but we’re surviving on price & availability only. We can keep the business – if we always meet the latest ask. The customer won’t pay us extra for any unique qualities.

Not really much of a sales success story, is it? We get the business for hitting a number on a spreadsheet, not due to any expertise in solving the customer’s unique needs. And we’re a prime target for getting kicked around on price.

Which poses the question… how much of our customer profitability problems are basically incomplete sales? Where we got in the door, sold a few things, but failed to build a truly sustainable relationship with the customer?

This interpretation actually fits the facts fairly well. The chart below maps those same profitability metrics against the likely degree of sales success. The sad thing is when I look at this chart as a former sourcing manager, I can put put names in those boxes.

That collective gasp was from the sales team. Yes, I went there.

So is our customer profitability problem really a problem with how well we’re carving out a role within the account?

We won the order but failed to win the relationship.

Unhappy Accidents – Getting Worse Over Time

Your pricing team is supposed to prevent this. At some point in the relationship, we were supposed to have a plan to make this customer work. Either at an individual level or in support of some broader goal in the marketplace (getting traction on a new product, keeping a competitor at bay).

Perhaps the plan was a little contrived. Push hard enough and you can find a way to make any deal work on a spreadsheet. Pump up those future assumptions, tweak the product mix to feature high profit items, and wish away the negative surprises. In any event, we had a plan.

So what happened? Life.

- We stopped visiting with them after the first order

- Suppliers raised our cost and we didn’t pass it on

- They stopped talking to us after a service failure

- We forgot to follow-up when their mix of items changed

Unhappy accidents. And because we don’t have a strong relationship with the customer, we drifted further off plan. Most of these problems could be fixed if we invested in the relationship.

It’s time for sales to own and fix the unhappy accidents.