Ah, the sales report.

There are days where I think the finance department really needs to take lessons from the selling team on the subject of “pro-forma” accounting. Because when our bonuses are on the line, we’ve got them beat hands down as story tellers.

It’s not just our innate ability to spin credible tales from tenuous assumptions. The outcome of our work is often shrouded in uneven math. You can show great progress and miss your plan at the last moment. Or salvage it. The show really never ends.

Here’s the real problem: Not all business is created equal.

Sales Measurement – Signal vs. Noise

Sure, your bonus check is probably tied to aggregate sales.

But managing progress towards that sales target? Needs a totally different perspective..

Let’s start with the sales representative. The typical outside sales representative at a B2B distributor is likely calling on a list of thirty to a hundred end user accounts. However, if you look closer, you will find most of their sales are generated from three to five major relationships.

This is a human constraint, by the way. I’ve worked in half a dozen industries. I cannot recall a sales representative who was actively cultivating more than a half-a-dozen big accounts. They may have more suspects and prospects, of course, but there’s a basic time and energy constraint around the relationship building needed for a major deal.

So when you’re measuring rep performance, you’re basically measuring how well their top accounts are doing. Most of the little stuff is drowned out…

Measuring customer performance often has a similar issues. Many medium sized accounts can swing wildly back and forth based on order timing, particularly if you’ve already made efforts to consolidate small orders and build trucks. Buying a truck early can swing short term measurements wildly. With no likely effect on your annual results.

The problem is that most of these events aren’t really actionable or useful from a sales management perspective. They bought a week early? Ship it. Your big national account is exiting us? Tell me something I don’t know.

Give someone a complicated report, they can spin it into whatever story they want.

Except that’s not going to help us earn our bonuses….

Better: Position Within The Account

You know what I care about? Grabbing Territory.

Taking control of fundamental blocks of a customer’s business and securing them against competitive threats.

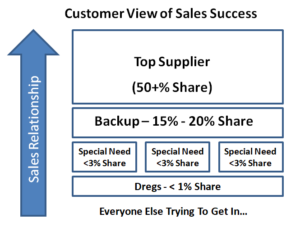

Let’s go back to the customer perspective again:

This is a good view of the chessboard for our account development efforts. We’re trying to build towards the top slot in as many customer categories as possible. And if we can’t get the top slot, we want to be either a specialist or the heir apparent.

Clone this view for multiple categories and customers and you have a good map of the overall market opportunity.

In fact, we can ignore the dollar amount of sales invoices and look at metrics such as # items qualified and orders received to assess our role using very objective standards. From there, it becomes a matter of counting up the wins.

You can even us this to split out new vs. existing territory. New business is often disadvantaged in traditional analysis: it takes time for new accounts to ramp up, limiting their impact on current year sales. This hurts your growth rates.

Clear Focus on Sales Rep Impact

This also neatly insulates the metric from many of the typical games. Big orders. Loading in. “Timing issues”. Other forms of hand-shuffling to explain why the volume didn’t show up but is “coming, any day now”…

Meh. A customer is either buying regularly or they’re not. We’re getting their full bundle or they’re cherry picking us. Most of the products we’re talking about are high volume repeat use items within their account. This should be steady.

This approach shows you who – and where – is growing…